Sell put option calculator

Strike price Rs 2000. If the signs point to downsizing put an expert in your corner.

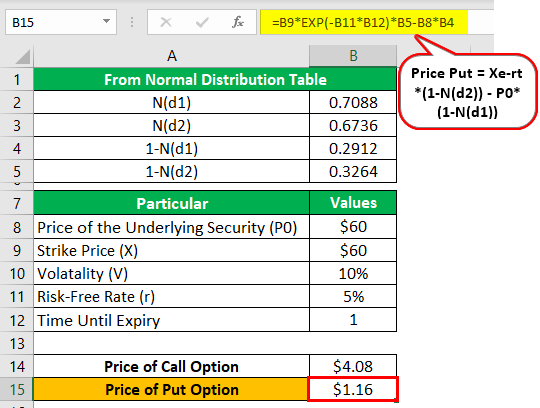

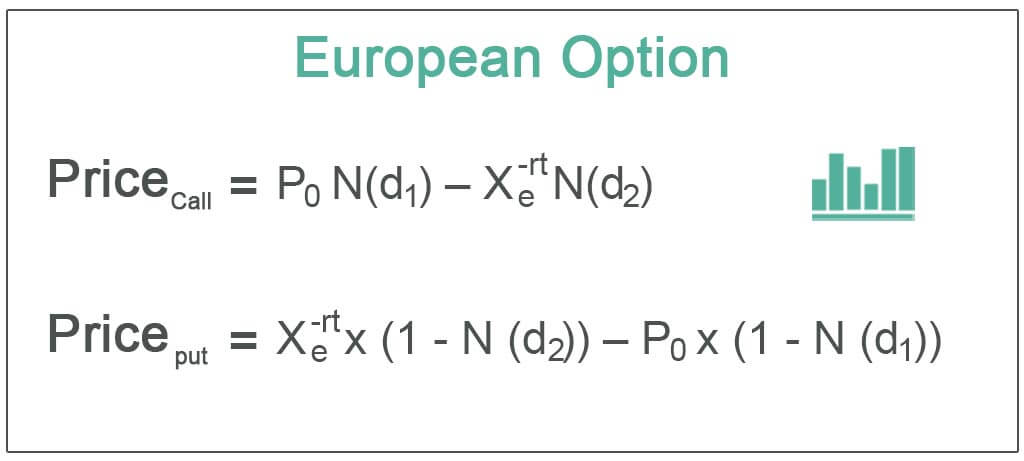

European Option Definition Examples Pricing Formula With Calculations

For example if underlying price is 3615 you can exercise the put option and sell the underlying security at the strike price 4000.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

. Expiry 31st December 2020. The payment of the strike price results in a transfer of the. If you purchase or sell a commodity future or sell a commodity option or if you purchase or sell an equity index exchange future or sell an equity index exchange option you may sustain a.

From t-shirts to posters backpacks to books you can put your own original spin on everyday products and sell them online. If the stock price falls below the strike price the buyer of the put. Account for interest rates and break down payments in an easy to use amortization schedule.

The investor who bought the put option has the right to sell the stock to the writer for their agreed-upon price until the time frame ends. Turn Your Trading Record Around. For both plans Amazon also collects a.

You can immediately buy it back on the market for 3615. Value strike - stock price. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Disappointed With Your Returns. Last specify the quantity. With a credit score of at least 580 you can make a down payment of as little as.

A put option can make another investor or trader buy or sell a security before the option expires. Though some mortgage loans may only require as little as 35 percent down or none at all a larger down payment will have a greater. When you sell a put option you are giving the option holder the right to sell you shares at the strike price.

Next choose the side ie. Retirement can be the happiest day of your life. A put option gives the holder of the option the right but not the obligation to sell a given number of shares of stock at a certain price known as the strike price.

This pre-retirement calculator was developed to help you determine. What are you waiting for. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

So in the above call option example. The exercise or strike price states the amount that must be paid to buy the call warrant or to sell the put warrant. It includes the Excel calculator xlsx and comes with a 27-page detailed PDF tutorial on how to use it to value stocks and calculate option premium returns as well as a 30-page booklet that.

The Profit at expiry is its value less the premium initially paid for the option. However if you go the traditional route of buying and. One is the strike The.

My put credit spreads treated me incredibly well over an 18 month span. Maybe youve recently changed jobs hope to be closer to your grandkids or like many recent sellers. Ad See how this trading course helps small investors earns Extra Income.

Whether you want to buy or sell the futures. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. You can make a lower down payment.

The Professional plan costs 3999 per month no matter how many items you sell. The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option. For the Options calculator there are two additional things to specify.

Come and visit our site already thousands of classified ads await you. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Heres how ordinary people are earning 5000 - 20000 each month in their spare time.

With the Individual plan youll pay 099 every time you sell an item. Youre ready to sell your home so you can embark on some new exciting chapter of life. Learn To Sell Covered Calls.

Option premium Rs 5715. When to buy the call option. FHA loans also give the option for a smaller down payment.

However the investor is not obligated to. Gain access to the Nasdaq-100 Index at 1100th the notional value. Retirement Savings Calculator Am I saving enough for my retirement.

When you sell a put option on a stock youre selling someone the right but not the obligation to make you buy 100 shares of a company at a certain price called the strike price before a. Its important to evaluate the financial emotional and practical aspects of downsizing in order to determine if. A put options Value at expiry is the puts strike price less the underlying stock price.

Lot Size 505 shares. Its easy to use no lengthy. Ad Patented Covered Call Option Search Engine.

All classifieds - Veux-Veux-Pas free classified ads Website. A 20 down payment is standard if you can afford it. Cloud computing is the on-demand availability of computer system resources especially data storage cloud storage and computing power without direct active management by the user.

Use our free mortgage calculator to estimate your monthly mortgage payments. A put option always comes with a strike price that you set to keep you from.

European Option Definition Examples Pricing Formula With Calculations

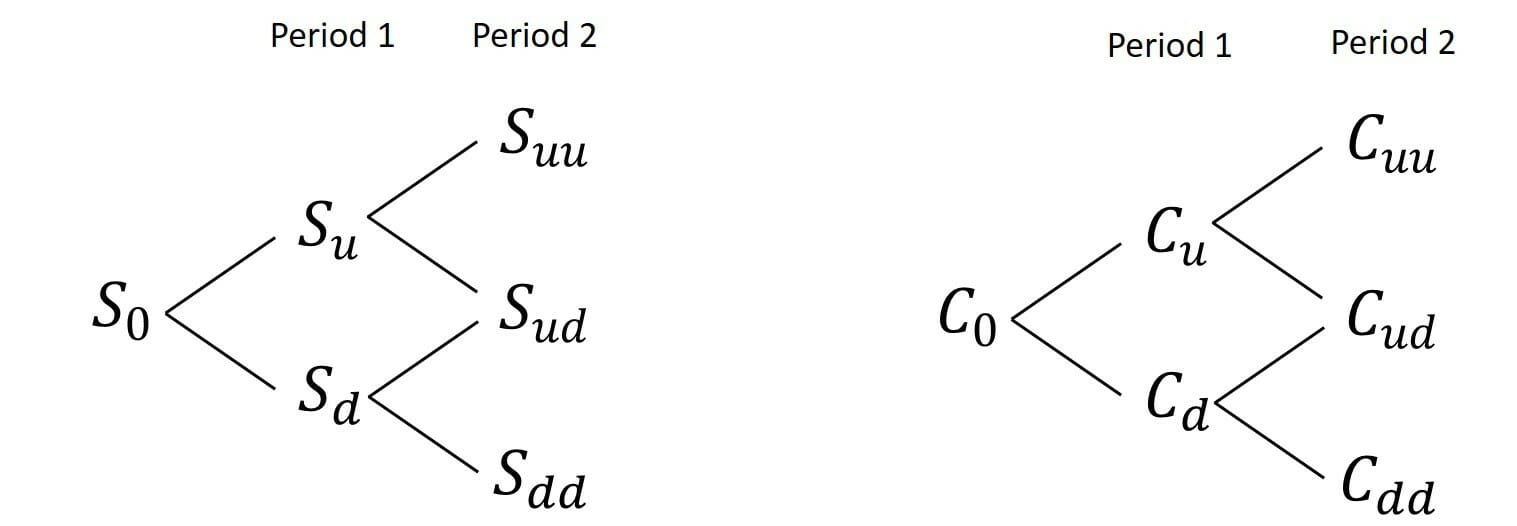

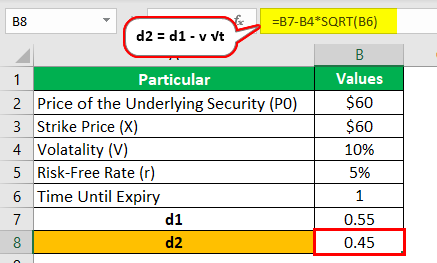

Option Pricing Models How To Use Different Option Pricing Models

How And Why Interest Rates Affect Options

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

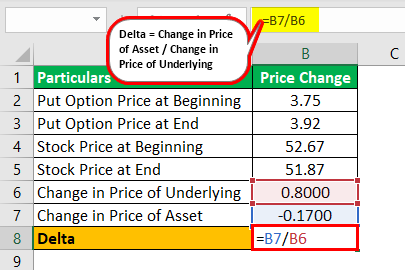

Delta Formula Definition Example Step By Step Guide To Calculate Delta

Call Option Calculator Put Option

What Is Call Option And Put Option A Beginner S Guide

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)

Options Basics How To Pick The Right Strike Price

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

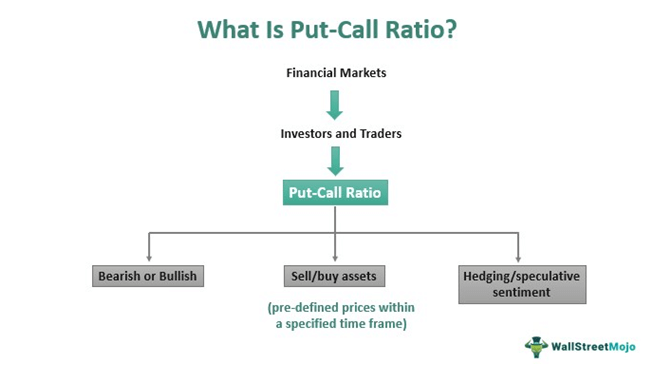

Put Call Ratio Meaning Example Indicator Trading Strategy

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

Options Buying Vs Selling Which Strategy To Use Trade Brains

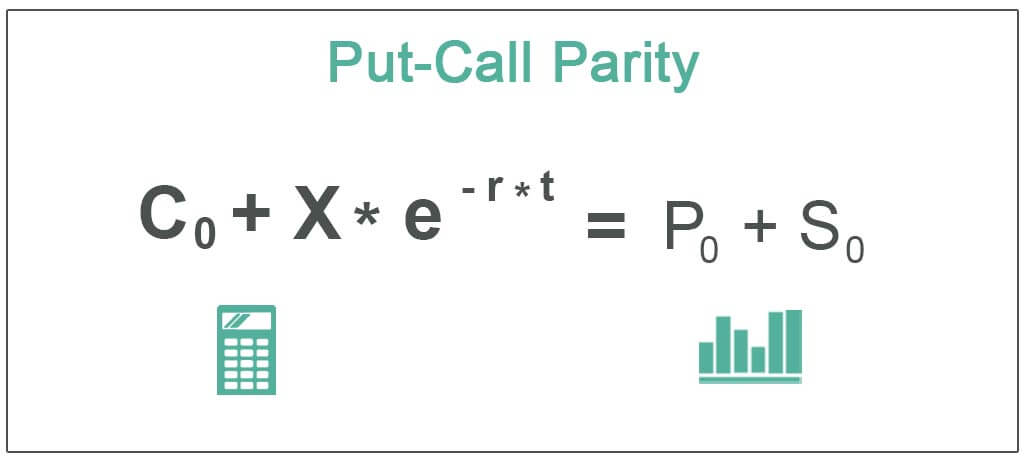

Put Call Parity Meaning Examples How Does It Work

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation